Outline

- Introduction

- Understanding Same Day Loans

- Factors Affecting Approval Speed

- Credit Score and History

- Loan Amount

- Type of Loan

- Lender’s Processing Time

- Types of Same Day Loans

- Payday Loans

- Online Personal Loans

- Title Loans

- Benefits of Same Day Loans

- Quick Access to Funds

- Convenience

- Emergency Situations

- Drawbacks of Same Day Loans

- High Interest Rates

- Short Repayment Terms

- Risk of Debt Cycle

- Tips to Expedite Loan Approval

- Improve Credit Score

- Prepare Necessary Documents

- Choose the Right Lender

- Applying for Same Day Loans

- Online Application Process

- In-Person Application Process

- Comparing Same Day Loan Options

- Interest Rates

- Fees and Charges

- Repayment Terms

- Legal Considerations

- Regulations and Consumer Rights

- Understanding Terms and Conditions

- Case Studies and Real-Life Examples

- Conclusion

- FAQs About Same Day Loans

- What documents are typically required for a same day loan?

- Can I get a same day loan with bad credit?

- Are same day loans safe?

- How can I avoid scams when applying for a same day loan?

- What alternatives are there to same day loans?

Today

In today’s fast-paced world, the need for quick financial solutions is more pressing than ever. This is where same day loans come into play, offering borrowers the promise of rapid access to funds when time is of the essence.

Introduction

When facing unexpected expenses or urgent financial needs, the ability to secure a loan on the same day can be a lifesaver. This article explores the intricacies of how quickly one can get same day loans approved, shedding light on the processes, factors influencing approval speed, and essential tips for borrowers.

Understanding Same Day Loans

Same day loans refer to financial products that promise funding within 24 hours of application approval. These loans are designed to cater to emergencies and unforeseen expenses, offering a quick remedy to cash-flow problems.

Factors Affecting Approval Speed

Several factors determine how quickly you can get a same day loan approved:

Credit Score and History

Your credit score plays a crucial role in loan approval speed. Higher credit scores generally lead to faster approvals, as they indicate lower risk to lenders.

Loan Amount

The amount of the loan requested can impact approval speed. Smaller loan amounts often have faster processing times compared to larger sums.

Type of Loan

Different types of same day loans (e.g., payday loans, personal loans, title loans) have varying approval processes. Some may require less documentation and verification, expediting approval.

Lender’s Processing Time

The efficiency of the lender’s processing system significantly influences how quickly you can get approved for a same day loan. Online lenders, for instance, may offer faster processing times than traditional banks.

Types of Same Day Loans

Same day loans come in various forms, each catering to different financial needs and circumstances:

Payday Loans

Payday loans are short-term loans typically repaid on your next payday. They are known for their quick approval process but often come with high interest rates.

Online Personal Loans

Online personal loans can be obtained quickly through digital platforms. They offer flexibility in loan amounts and repayment terms, making them a popular choice for urgent financial needs.

Title Loans

Title loans involve using your vehicle’s title as collateral. They provide fast access to funds but carry the risk of losing your vehicle if you default on payments.

Benefits of Same Day Loans

Quick Access to Funds

Same day loans provide immediate access to cash, ensuring you can address urgent financial needs promptly.

Convenience

The streamlined application processes of same day loans offer convenience, especially when time is of the essence.

Emergency Situations

These loans are invaluable during emergencies like medical expenses or car repairs, where immediate funds are critical.

Drawbacks of Same Day Loans

While convenient, same day loans come with certain drawbacks that borrowers should consider:

High Interest Rates

Many same day loans charge high interest rates, making them costly if not repaid quickly.

Short Repayment Terms

Short repayment periods mean higher monthly payments, potentially straining your budget.

Risk of Debt Cycle

Borrowers may fall into a cycle of borrowing to repay previous loans, leading to long-term financial issues.

Tips to Expedite Loan Approval

To improve your chances of swift approval for a same day loan, consider the following tips:

Improve Credit Score

Maintaining a good credit score increases your chances of quick loan approval.

Prepare Necessary Documents

Have all required documents ready, such as proof of income and identification, to expedite the application process.

Choose the Right Lender

Research lenders to find one with a reputation for fast approvals and transparent terms.

Applying for Same Day Loans

The application process for same day loans varies depending on the lender:

Online Application Process

Online lenders typically offer a straightforward application process, with approval decisions often within hours.

In-Person Application Process

Traditional lenders may require in-person visits, which can lengthen the approval timeline.

Comparing Same Day Loan Options

When considering same day loans, compare:

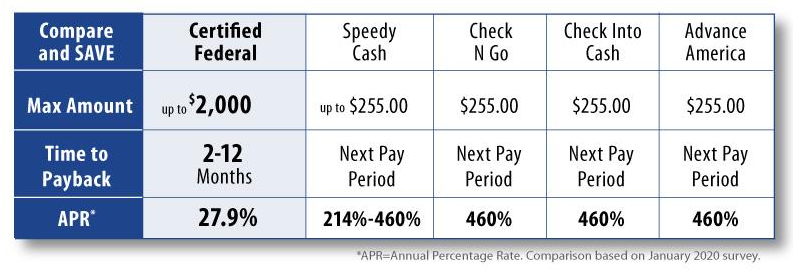

Interest Rates

Compare interest rates to find the most competitive offer.

Fees and Charges

Review fees and charges associated with the loan to avoid unexpected costs.

Repayment Terms

Understand repayment terms, including penalties for late payments or early repayment.

Legal Considerations

Before committing to a same day loan, familiarize yourself with:

Regulations and Consumer Rights

Ensure the lender complies with local regulations governing lending practices.

Understanding Terms and Conditions

Read and understand all terms and conditions to avoid surprises during repayment.

Case Studies and Real-Life Examples

Exploring real-life scenarios can provide insight into how same day loans have helped individuals in different situations.

Conclusion

In conclusion, same day loans offer a vital financial lifeline during emergencies. By understanding the factors influencing approval speed, choosing the right loan type and lender, and managing finances responsibly, borrowers can navigate the process effectively. Remember to weigh the benefits against the risks and always explore alternatives before committing to a same day loan.

FAQs About Same Day Loans

What documents are typically required for a same day loan?

Typically, you’ll need proof of income, identification (such as a driver’s license), and bank account information.

Can I get a same day loan with bad credit?

Yes, some lenders offer same day loans to individuals with less-than-perfect credit. However, expect higher interest rates and stricter terms.

Are same day loans safe?

Same day loans can be safe if obtained from reputable lenders. It’s essential to research and choose lenders wisely.

How can I avoid scams when applying for a same day loan?

Avoid scams by verifying the legitimacy of lenders, reviewing customer feedback, and understanding all terms and conditions before signing.

What alternatives are there to same day loans?

Alternatives include borrowing from friends or family, using credit cards, or exploring community resources for financial assistance.