Life is full of unexpected events that can strain your finances. Emergency loans provide quick access to funds when you need them most, whether it’s for medical bills, car repairs, or other unforeseen expenses. This guide will help you understand what emergency loans are, how they work, their benefits and drawbacks, and tips for securing the best loan.

What is an Emergency Loan?

An emergency loan is a type of short-term personal loan designed to cover urgent, unexpected expenses. These loans are typically unsecured, meaning they don’t require collateral. Emergency loans can be obtained from banks, credit unions, and online lenders, often with a quick approval process to provide immediate funds.

How Emergency Loans Work

The process of obtaining an emergency loan is relatively straightforward:

- Application: You can apply for an emergency loan online or in person. The application process typically requires personal identification, proof of income, and a bank account.

- Approval: Approval times for emergency loans are usually fast, often within minutes to a few hours. Lenders may perform a soft or hard credit check as part of the approval process.

- Funding: Once approved, the loan amount is deposited into your bank account, usually within one business day. Some lenders offer same-day funding.

- Repayment: Emergency loans are typically repaid in fixed monthly installments over a period of a few months to a few years. The repayment terms vary by lender.

Types of Emergency Loans

Several types of emergency loans are available, each catering to different needs and situations:

1. Personal Loans

Personal loans can be used for various emergency expenses and are available from banks, credit unions, and online lenders. They usually offer fixed interest rates and repayment terms.

2. Payday Loans

Payday loans are short-term, high-interest loans typically due on your next payday. While they offer quick access to cash, they come with significant risks and high costs.

3. Credit Card Cash Advances

A cash advance from your credit card allows you to borrow against your credit limit. This option can be convenient but often comes with high interest rates and fees.

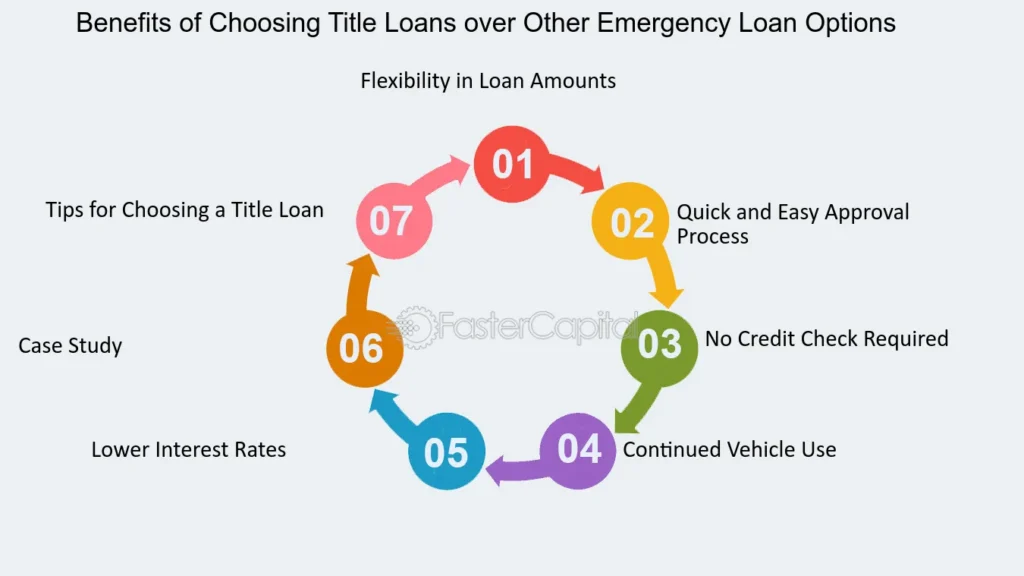

4. Title Loans

Title loans are secured loans that use your vehicle as collateral. These loans can provide quick cash but put your vehicle at risk if you fail to repay.

5. Lines of Credit

Personal lines of credit offer flexible access to funds up to a certain limit. You only pay interest on the amount you borrow. These can be useful for ongoing or unpredictable expenses.

Benefits of Emergency Loans

Emergency loans offer several advantages:

1. Quick Access to Funds

Emergency loans are designed to provide fast financial relief, with many lenders offering same-day or next-day funding.

2. No Collateral Required

Most emergency loans are unsecured, meaning you don’t need to provide collateral, such as your home or car, to secure the loan.

3. Flexible Use

Funds from emergency loans can be used for a variety of purposes, from medical bills to car repairs or other unexpected expenses.

4. Fixed Interest Rates and Payments

Many emergency loans come with fixed interest rates and repayment terms, making it easier to budget and plan your finances.

Drawbacks of Emergency Loans

While emergency loans can be helpful, they also have potential drawbacks:

1. High Interest Rates

Some emergency loans, especially payday loans and cash advances, come with high interest rates and fees, making them expensive options.

2. Short Repayment Terms

Short repayment periods can make it challenging to repay the loan on time, leading to additional fees and interest charges.

3. Risk of Debt Cycle

Borrowers may find themselves in a cycle of debt if they rely on emergency loans frequently or fail to repay them on time.

Tips for Securing the Best Emergency Loan

To get the best deal on an emergency loan, consider the following tips:

1. Check Your Credit Score

Your credit score affects your loan terms and interest rates. Check your credit score before applying and take steps to improve it if necessary.

2. Compare Lenders

Shop around and compare loan offers from multiple lenders, including banks, credit unions, and online lenders. Look at interest rates, fees, and repayment terms.

3. Read the Fine Print

Carefully read the loan agreement, including all fees, interest rates, and terms. Make sure you understand the total cost of the loan.

4. Consider Alternatives

Explore other options before taking out an emergency loan. This could include borrowing from friends or family, negotiating payment plans with creditors, or using a credit card.

5. Borrow Only What You Need

Limit the loan amount to what you need to cover your emergency expenses. Avoid taking out larger loans than necessary to minimize debt.

Alternatives to Emergency Loans

If an emergency loan isn’t the right fit, consider these alternatives:

1. Credit Union Loans

Credit unions often offer small, short-term loans with more favorable terms compared to payday loans. These loans can be a more affordable option.

2. Employer Advances

Some employers offer paycheck advances as a benefit to employees facing financial emergencies. This option can provide quick cash without the high costs of payday loans.

3. Local Assistance Programs

Community organizations and charities may offer financial assistance for essential expenses. Check with local nonprofits and government agencies for available resources.

4. Negotiating with Creditors

If you need funds for specific expenses like medical bills or utility payments, contact the provider to discuss payment plans or hardship programs.

Conclusion

Emergency loans can provide critical financial relief in times of urgent need, but they come with significant costs and risks. Understanding how emergency loans work, the associated fees, and the potential pitfalls can help you make informed decisions. Whenever possible, consider alternatives that may offer more favorable terms and lower costs. If you must use an emergency loan, do so responsibly to minimize the financial impact and avoid getting trapped in a cycle of debt.